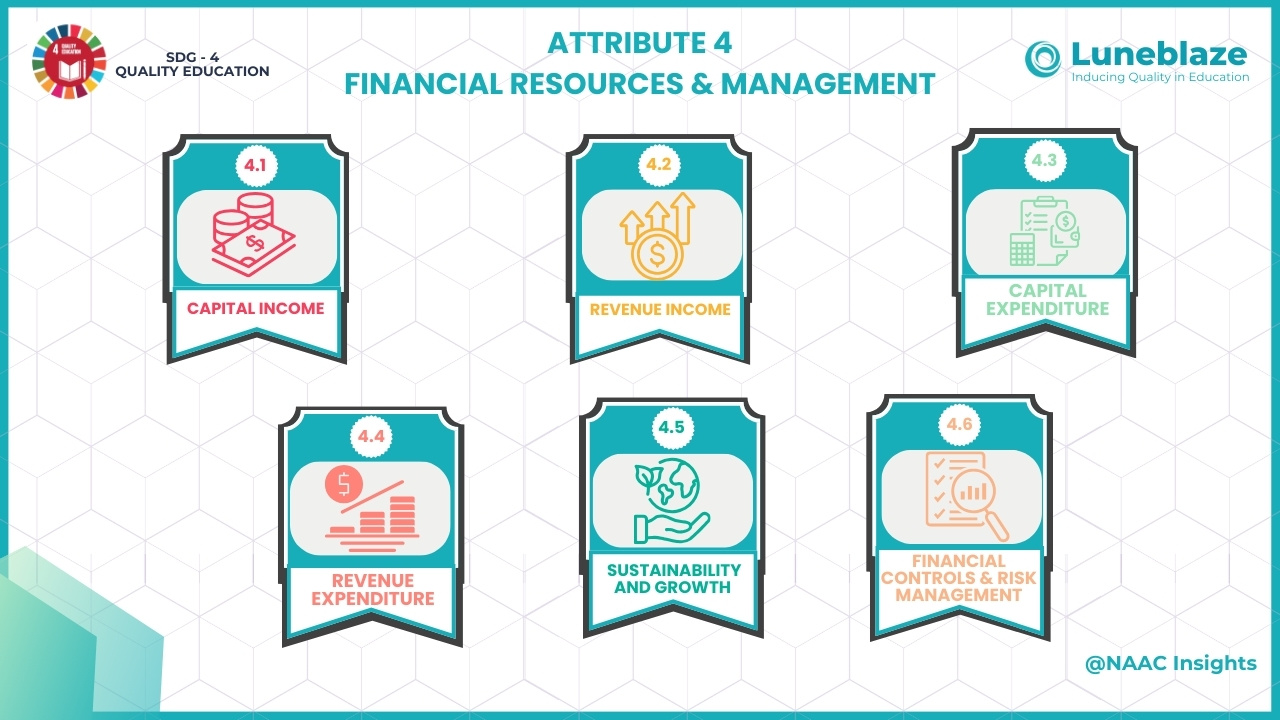

Financial Resources & Management: Attribute 4 in NAAC’s Binary Accreditation Framework

14 Apr 25

Imagine higher educational institutions (HEIs) as vibrant hubs of innovation, research, and opportunity, offering cutting-edge education while remaining financially stable and resilient. This vision is made possible through effective financial resources and management, which are essential for any institution striving for excellence. A solid financial strategy supports educational goals, ensures long-term sustainability, and allows for growth in infrastructure, programs, and faculty wellbeing. Effective financial management goes beyond balancing the books; it empowers institutions to maintain high standards, foster research, and benefit society. Under the NAAC Binary Accreditation Framework, HEIs are evaluated on their financial stability and management practices, ensuring that they have the resources to meet educational goals and sustain long-term growth. This framework emphasizes the importance of transparent financial management and planning, enabling institutions to foster academic excellence while being financially resilient. In this blog, we will explore how HEIs can build a strong financial framework, focusing on income, expenditures, growth strategies, and risk management to safeguard their future and provide exceptional educational experiences.

4.1 Capital Income Capital income is vital for an institution’s financial strength, enabling investment in future growth. It typically comes from government grants, management contributions, loans, and endowments, and is used for large-scale projects like building new facilities and upgrading infrastructure. Government grants fund specific educational or research initiatives, while management contributions from governing bodies provide internal support for key projects. Endowments, built through alumni donations and philanthropy, offer long-term financial security, supporting scholarships and faculty development. A diversified capital income strategy ensures financial stability, reducing reliance on any single funding source and allowing institutions to pursue ambitious growth projects. 4.2 Revenue Income Revenue income is essential for sustaining daily operations and providing necessary services to students and staff. It is generated through tuition fees, research grants, consultancy services, alumni contributions, and other educational services. While tuition fees are a primary source, institutions must balance them with financial aid programs, such as scholarships, to ensure accessibility for all students. Research grants, awarded by government agencies or private organizations, support faculty and student innovation. Alumni contributions strengthen the institution’s financial foundation, funding scholarships and specific programs. A diverse revenue income strategy ensures financial stability, supports academic growth, and provides students with the resources they need to succeed. 4.3 Capital Expenditure Physical infrastructure—classrooms, labs, libraries, and student housing—forms the foundation of the student experience. Capital expenditure funds the building, upgrading, and maintenance of these assets. Investments in new or renovated facilities, like science labs or lecture halls, are crucial to meet growing student numbers and evolving programs. Capital expenditure also supports student services like hostels, recreation areas, and dining facilities, enhancing the overall experience. A successful strategy requires careful planning and prioritization to ensure projects drive academic excellence and long-term growth. 4.4 Revenue Expenditure Revenue expenditure covers the daily operational costs of an institution, including salaries, campus maintenance, utilities, student services, and other essential expenses. Salaries, typically the largest portion, must be competitive to attract and retain top faculty and staff. Investing in professional development helps educators stay current and deliver quality teaching. This expenditure also includes campus maintenance, ensuring a safe and conducive learning environment. Student services like career counseling, extracurricular activities, and health services support overall student success. By managing revenue expenditure effectively, institutions can allocate resources efficiently and maintain high educational standards. 4.5 Sustainability & Growth To ensure long-term success, institutions must prioritize financial sustainability and growth through a strategic plan. This plan should diversify income sources, build a corpus fund, and explore new opportunities. A corpus fund offers security for initiatives like research, scholarships, and faculty development during economic challenges. Decentralized budgeting allows departments to manage funds responsibly while aligning with strategic goals. Long-term planning also includes increasing capital and revenue income through industry partnerships, new programs, and alumni engagement. By focusing on sustainability, institutions can stay financially strong and adaptable to changing educational needs. 4.6 Financial Controls & Risk Management Effective financial management involves not only generating and spending funds but also protecting the institution’s financial resources. Financial controls and risk management are crucial for guarding against mismanagement, fraud, and unforeseen challenges. Internal audits ensure transparency and accountability by regularly reviewing financial transactions. External audits by independent auditors provide an additional layer of oversight, confirming the accuracy of financial statements. Risk management helps institutions identify and prepare for potential threats, such as enrollment changes or economic downturns, ensuring they can navigate challenges effectively. Strong financial controls and risk management maintain financial integrity and ensure resources are used efficiently. As higher education evolves, institutions must strategically manage financial resources to drive growth, innovation, and sustainability. By balancing smart investments, budgeting, and long-term planning, HEIs can create an environment where students and faculty thrive. With Luneblaze’s AI-driven solutions, institutions gain tools to simplify processes, enhance transparency, and align financial practices with educational goals, ensuring readiness for the future of education. To assist these efforts, Luneblaze provides a comprehensive end-to-end solution to HEIs for all their accreditation criteria needs. With the help of Luneblaze’s AI-enabled solutions, HEIs can organize and manage all their data related to accreditation. Together, let’s raise educational standards. Reach us at: naac@luneblaze.com

Trusted by

100+

Institutions

worldwide

since 2017

Get started with Accreditation Excellence

Explore how our AI-enabled accreditation solution simplifies the accreditation journey